|

Achieve financial security while maximizing your pension benefits

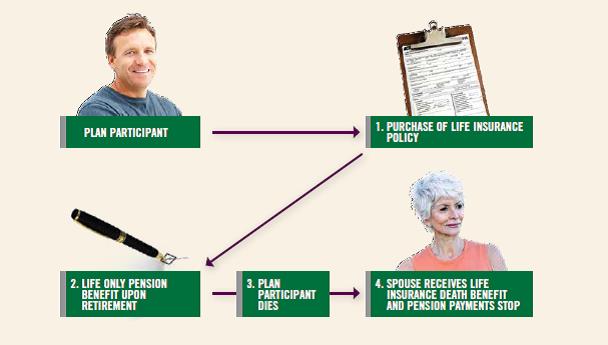

Pension maximization using life insurance is a way to gain needed death benefit protection while helping you get the most out of your defined pension benefits. If you are a participant in a traditional pension plan (also referred to as a “defined benefit plan”), you have a plan that is designed to provide you with monthly income payments upon retirement. First, however, you must make an irrevocable choice. Typically, your employer will give you two options for how the benefits will be paid—Life Only Benefit or Joint and Survivor Benefit. The Life Only option pays you the maximum benefit, but upon your death, your spouse does not continue to receive payments. The Joint and Survivor option pays a reduced benefit, but your spouse will continue to receive benefits when you die. The pension maximization strategy using life insurance is designed to be a compromise between the two options. It allows you to receive the higher pension benefit while also providing funds for your spouse in the form of a death benefit.

|

Advantages

• Immediate financial protection and control. From the start, you gain death benefit protection for your spouse.

When you die, your spouse receives the death benefit generally income tax-free.1 If you decide on the pension maximization strategy using life insurance, this death benefit replaces the pension income that stops.

• Higher monthly pension income. When you select the Life Only option, you receive a higher monthly benefit. If your spouse dies first, you aren’t left with the reduced benefit of the Joint and Survivor option. With this scenario you would also have potential access to any accumulated cash values in the policy through loans and withdrawals to help supplement retirement income.

• Opportunity to pass money to heirs. If your spouse predeceases you (the pension holder) and you keep the policy in force until death, any remaining life insurance death benefit would pass to your heirs.

Contact me today to start maximizing your Pension!

|

|

Maximize Your Pension with Life Insurance

Maximize Your Pension with Life Insurance