|

We provide our clients with an unique experience by providing them with a transaction structure that makes sense to both the institutional investors and the clients. There are no trial and error experiments. We do it right at the first time.

Debt & Equity

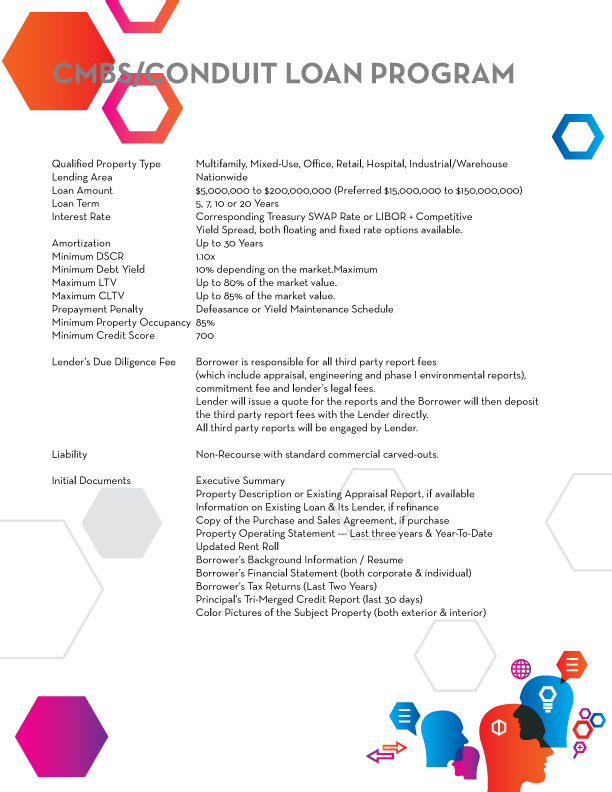

CMBS/Conduit

We provide competitive CMBS / Conduit financing options for income producing properties such as multifamily, office, retail, industrial and hospitality properties in domestic U.S. and Canada.

Hospitality

An unique portfolio hotel financing option is offered through its Hospitality lending program. The program focuses on mature hospitality properties in the United States, United Kingdom and most of the European markets.

Small Balance Multifamily Loan

Case 1

Purpose of Loan Refinance

Property Type 17-Unit Multifamily Property

Issues The main issue on the loan is the borrower’s tax returns. To avoid taxes, the borrower had decided to report only partial income received from the property and had inflated the operating expenses by several times, resulting in a loss of the operation when in fact, the property’s operation is quite healthy. We underwrote the deal using the Agency Microloan program which allowed us to write the loan strictly based on the property’s actual operation and therefore, ignored the use of tax returns. Under the Microloan program, tax returns are not a due diligence item. We were able to lower the rate by 2% from the existing loan and effectively lowering the borrower’s monthly payment by 40%.

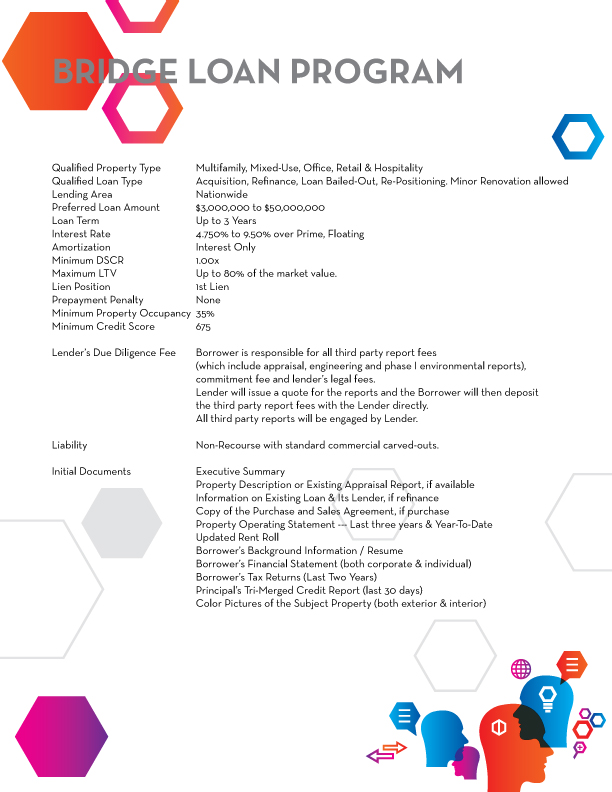

Bridge

The institutional Bridge Loan Program offers its clients an opportunity to take advantage of the current market condition when properties are being offered at a discount. With a clear exit, the transactions can often be funded within a few working days. This program is available for properties located within the continental United States.

Case 1

Purpose of Loan Acquisition

Property Tyep Office

Issues The borrower came to us with only 15 days remained on the contract. Her application to the local bank we delayed for two months due to the vacancy on the second floor which represented 50% of the NRSF. The tenant on the first floor is a national tenant with long term lease and the borrower intends to move her business to the second floor. Based on the property’s current value and the cash flow generated from the first floor tenant, we were able to approve the loan within hours upon receipt of the application. All due diligence were completed within 72 hours and we were able to close and successfully fund the loan in for working days.

Case 2: Institutional Bridge Loan

Purpose of Loan Acquisition

Property Type Single Tenant (Non-Credit) Building being used as a college

Issues The key issues on this transaction are (i) the tenant is not credit rated; (ii) the property has been renovated and rebuilt specifically for the sole purpose of serving as the main campus of a national for-profit college, the alternative use is limited; (iii) aggressive LTV. Based on the recent investment made by both the seller and the tenant in capital improvements, we were comfortable with the property’s equity position. Based on the potential income, we structured a two tier loan with a senior loan at 75% and a mezzanine loan for an additional 10% and making the total loan amount with a CLTV at 85% based on the total transaction costs. The borrower is a newly formed investment vehicle with third party investors and therefore, the loan is structured as a non-recourse loan with standard carved-outs.

Mezzanine/Preferred Equity

Our institutional Mezzanine / Preferred Equity Loan Program offers the sponsors access to proceeds not available by conventional lending. This Mezzanine / Preferred Equity program available to both new and existing loan portfolios.

SBA Business Financing

We Have Access to the Small Business Loan Exchange With 100 + Banking Partners available to you and Funding in all 50 states.

Our Goal: To Help Small Businesses to Increase Their Income and Save Money Through Government Guaranteed Financing.

Benefits of SBA Financing

#1 Benefit; Access to Capital

Longer terms 7 to 25 Years

Competitive Interest Rates

Easier Qualifying Guidelines

Lower Payments

Start up and Established Business’ OK

Low Down Payment, 10% to 30%

Can be Assumable, SBA Approval

Items of Underwriting

Credit

Capital

Collateral

Cash Flow

Capacity

Character

The Probability of Success.

Loan Package Components

Business Plan

Tax Returns

Financial Statements

Use of Proceeds

Statement of Equity

Credit Reports

Supporting Documents

Other Factors

Time in Business

Owners Cash Investment

Success of Industry

Resumes of Key Employees

Location Lease

A Bigger Package is Better

Compensating Factors

Eligibility

Restaurants?Yes

Start up Business?Yes

Equipment Purchase?Yes

Practice Expansion, Partner Buyout?Yes

Land Purchase and Construction?Yes

Permanent Resident Alien?Yes

Working Capital?Yes

Real Estate Purchase?Yes

How to Obtain Financing

Initial SBA Eligibility Consultation

Review Retainer Fee Agreement & Form 159

Complete Preliminary Application

Letter of Intent Issued

Complete SBA Application

Submit Documentation to Lender

Funding within 45 Days

Funds Received –Wire or Check

Available Loan Programs

7(a) Loans

Patriot Express

504 Loans

7(a) Loans

Bank loans money, SBA guarantees up to 75% of the loan amount. (Currently 90%)

Loans up to $2,000,000, guaranteed loan amount is $1,500,000

Use for commercial real estate purchase, construction, improvements, debt refinance, equipment purchase, working capital, business expansion, revolving line of credit

What’s Not Eligible

100% Gaming, less than 20% of Revenue

All Lending Companies

Pawn Shops

Adult Business’

Apartment Complexes

Pure Investment Properties

Mini Storage

Patriot Express

Same as 7(a) but for Veterans

Maximum Loan to $500,000

SBA Guarantee up to 85%

Fixed Term or Revolving Line of Credit

Disabled Vets, Current or Widowed Spouse,

Reservists and National Guard

51% Ownership

504 Loan Program

Real Estate Purchase or Construction and Expensive Equipment with 10 year Life+

Minimum is $250,000

Maximum Project Cost $8MM

50,40,10 Loan

Bank Lends 50%,SBA/CDC Lends 40%

Borrower Invest 10%

Must be Owner Occupied Property

504 Eligibility

Same as 7(a) +

No more than $8MM in net assets

Fixed 1st5 years, Adjustable based on Index

Flexibility-3/1, 5/1 25 year amortization

Fixed 2nd20 year Term

Prepayment Penalty on Both Loans

|